- Macworld Usa January 2017 Calendar

- Macworld Usa January 2017 Calendar Printable

- Macworld Usa January 2017 Holiday

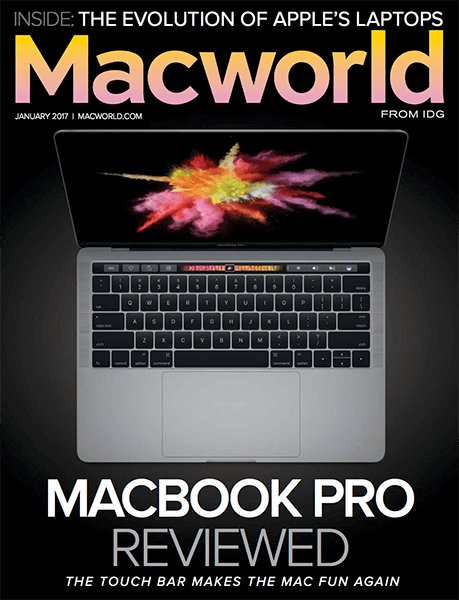

Stay on top of today's fast-changing Apple technology with Macworld magazine! Macworld is the ultimate resource for savvy users of Apple products. Every issue is filled with authoritative news, analysis, and tips about all things Apple — Mac, iPhone, iPad, and beyond! Best of all, Macworld brings you the most trusted product reviews, from Apple hardware to accessories to the very best apps. Make the most of your iPhone. Get work done on your iPad. Shoot videos with pizzazz. Print gorgeous digital photos. Make the most of your Apple products with Macworld!

Steve Jobs, CEO of Apple Inc., demonstrates the new iPhone, during the keynote speech at the MacWorld Expo in San Francisco, California, on January 9, 2007. Previous Magazine Women's Health & Fitness Australia – March 2018; Next Magazine All About History – Issue 62 2018.

.

http://www.rarefile.net/ofyl2awhal7r/MacworldUSA.Sept2020.zip

.

Cost-of-Living Adjustment (COLA) Information for 2021

Social Security and Supplemental Security Income (SSI) benefits for approximately 70 million Americans will increase 1.3 percent in 2021.

The 1.3 percent cost-of-living adjustment (COLA) will begin with benefits payable to more than 64 million Social Security beneficiaries in January 2021. Increased payments to more than 8 million SSI beneficiaries will begin on December 31, 2020. (Note: some people receive both Social Security and SSI benefits)

Read more about the Social Security Cost-of-Living adjustment for 2021.

The maximum amount of earnings subject to the Social Security tax (taxable maximum) will increase to $142,800.

The earnings limit for workers who are younger than 'full' retirement age (see Full Retirement Age Chart) will increase to $18,960. (We deduct $1 from benefits for each $2 earned over $18,960.)

The earnings limit for people reaching their 'full' retirement age in 2021 will increase to $50,520. (We deduct $1 from benefits for each $3 earned over $50,520 until the month the worker turns 'full' retirement age.)

There is no limit on earnings for workers who are 'full' retirement age or older for the entire year.

Read more about the COLA, tax, benefit and earning amounts for 2021.

Medicare Information

Information about Medicare changes for 2021, when announced, will be available at www.medicare.gov. For Social Security beneficiaries receiving Medicare, Social Security will not be able to compute their new benefit amount until after the Medicare premium amounts for 2021 are announced. Final 2021 benefit amounts will be communicated to beneficiaries in December through the mailed COLA notice and mySocial Security's Message Center.

Macworld Usa January 2017 Calendar

Your COLA Notice

In December 2020, Social Security COLA notices will be available online to most beneficiaries in the Message Center of their mySocial Security account.

Macworld Usa January 2017 Calendar Printable

This is a secure, convenient way to receive COLA notices online and save the message for later. You can also opt out of receiving notices by mail that are available online. Be sure to choose your preferred way to receive courtesy notifications so you won't miss your secure, convenient online COLA notice.

Remember, our services are free of charge. No government agency or reputable company will solicit your personal information or request advanced fees for services in the form of wire transfers or gift cards. Avoid falling victim to fraudulent calls and internet 'phishing' schemes by not revealing personal information, selecting malicious links, or opening malicious attachments. Aurora hdr pro 1 2 6 download free. You can learn more about the ways we protect your personal information and mySocial Security account here.

History of Automatic Cost-Of-Living Adjustments (COLA)

Macworld Usa January 2017 Holiday

The purpose of the COLA is to ensure that the purchasing power of Social Security and Supplemental Security Income (SSI) benefits is not eroded by inflation. It is based on the percentage increase in the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W) from the third quarter of the last year a COLA was determined to the third quarter of the current year. Soul axiom 1 0. If there is no increase, there can be no COLA.

The CPI-W is determined by the Bureau of Labor Statistics in the Department of Labor. By law, it is the official measure used by the Social Security Administration to calculate COLAs.

Congress enacted the COLA provision as part of the 1972 Social Security Amendments, and automatic annual COLAs began in 1975. Before that, benefits were increased only when Congress enacted special legislation.

Beginning in 1975, Social Security started automatic annual cost-of-living allowances. The change was enacted by legislation that ties COLAs to the annual increase in the Consumer Price Index (CPI-W).

The change means that inflation no longer drains value from Social Security benefits.

The 1975-82 COLAs were effective with Social Security benefits payable for June (received by beneficiaries in July) in each of those years. After 1982, COLAs have been effective with benefits payable for December (received by beneficiaries in January).

Automatic Cost-Of-Living Adjustments received since 1975

- July 1975 -- 8.0%

- July 1976 -- 6.4%

- July 1977 -- 5.9%

- July 1978 -- 6.5%

- July 1979 -- 9.9%

- July 1980 -- 14.3%

- July 1981 -- 11.2%

- July 1982 -- 7.4%

- January 1984 -- 3.5%

- January 1985 -- 3.5%

- January 1986 -- 3.1%

- January 1987 -- 1.3%

- January 1988 -- 4.2%

- January 1989 -- 4.0%

- January 1990 -- 4.7%

- January 1991 -- 5.4%

- January 1992 -- 3.7%

- January 1993 -- 3.0%

- January 1994 -- 2.6%

- January 1995 -- 2.8%

- January 1996 -- 2.6%

- January 1997 -- 2.9%

- January 1998 -- 2.1%

- January 1999 -- 1.3%

- January 2000 -- 2.5% (1)

- January 2001 -- 3.5%

- January 2002 -- 2.6%

- January 2003 -- 1.4%

- January 2004 -- 2.1%

- January 2005 -- 2.7%

- January 2006 -- 4.1%

- January 2007 -- 3.3%

- January 2008 -- 2.3%

- January 2009 -- 5.8%

- January 2010 -- 0.0%

- January 2011 -- 0.0%

- January 2012 -- 3.6%

- January 2013 -- 1.7%

- January 2014 -- 1.5%

- January 2015 -- 1.7%

- January 2016 -- 0.0%

- January 2017 -- 0.3%

- January 2018 -- 2.0%

- January 2019 -- 2.8%

- January 2020 -- 1.6%

- January 2021 -- 1.3%